A Road to Ownership: Comprehending Motorbike Financing Choices

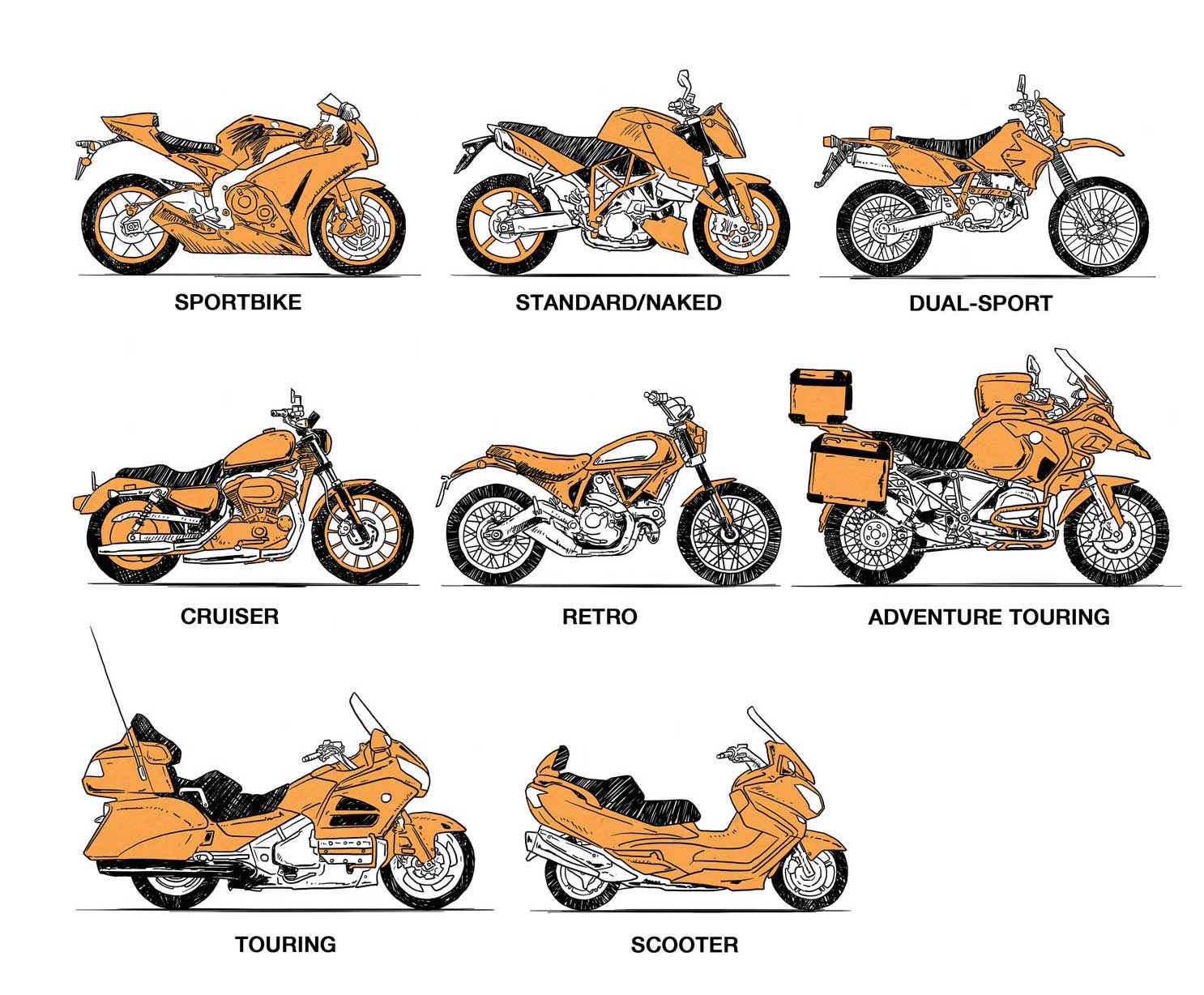

For countless enthusiasts, owning a motorbike is not just about transportation; it's a lifestyle choice that embodies freedom and thrill. Yet, financing a motorcycle can frequently seem overwhelming, with a variety of options to choose from to navigate. Whether you are looking to buy a brand new superbike, a dependable used motorbike, or even a custom motocross bike, comprehending your motorbike finance options is essential to making an informed decision that fits your budget and riding goals.

In this guide, we will examine the different motorcycle finance deals available, from conventional loans to installment motorbike options. We will look into how motorcycle loan lenders work, what to look for in the top motorcycle loans, and how you can get budget-friendly motorcycle loans that align with your financial situation. With the correct information, you will be fully prepared to embark on the road to ownership with confidence.

Comprehending Motorbike Finance Options

Motorbike finance is an essential aspect for those wanting to purchase a motorcycle but that may not have the total sum upfront. It includes various options tailored to fit diverse needs and budgets. Whether https://www.motorhype.co.uk/bike-finance/ are evaluating a brand new high-performance motorcycle or a second-hand motorcycle, knowing the available financing options can help you make informed decisions. From motorcycle financing to more niche offers, understanding the landscape of motorcycle finance can lead the way to ownership.

One of the most prevalent ways to finance a bike is via a motorcycle loan. This can be obtained from banks, credit unions, or specialized motorcycle loan lenders. These loans typically offer competitive loan terms and flexible payment plans, making it more manageable to handle monthly payments. It's important to investigate and contrast motorcycle loans online to find the most favorable motorcycle loan rates that meet your financial situation. The goal is to obtain a deal that allows you to buy motorbike on finance with terms that you can sustainably maintain.

In addition to conventional loans, there are different motorcycle finance deals and offers available, particularly for those wanting to buy pre-owned motorcycles or specific models like motocross bikes and superbikes. Many dealerships offer pay monthly motorbike options that can make ownership more affordable. Furthermore, exploring straightforward motorcycle financing options can help individuals find low interest motorcycle loans that fit within their budget. Being knowledgeable about the variety of motorbike finance options is crucial to making the best financial decision for your journey on two wheels.

Types of Motorcycle Loans

When motorcycle finance, it's important to know the different kinds of motorcycle loans out there. The most frequent alternatives include collateralized loans, unsecured loans, and hire purchase agreements. Collateralized loans usually demand the vehicle to act as collateral, which can result in reduced interest rates. On the other hand, unsecured loans lack any collateral though they can carry higher interest rates. Hire purchase agreements let you to purchase the motorbike in installments, with you gaining ownership once the final payment is fulfilled.

Additionally, another common option is personal contract purchase, providing you the freedom to drive a motorbike for a specific period while paying lower monthly payments. At the end of the agreement, you have the option to either buy the bike by making a final balloon payment or return it. This type of motorcycle finance is ideal for those that wish to ride different bikes over the years without committing to ownership.

Finally, retail installment contracts are also frequent, where a motorcycle loan lender provides money for the acquisition, and you promise to repay it in set monthly installments over a defined period. These contracts can be adjusted to fit various budgets and are frequently paired with promotional motorcycle finance deals that offer lower interest rates for a limited time. Grasping these kinds of motorcycle loans can help you implement an informed decision when purchasing a motorcycle on finance.

Opting for the Appropriate Financing Deal

When choosing a motorcycle funding option, it is essential to evaluate your individual budget and financial circumstance before proceeding. Consider how much you can afford to pay every month for your motorcycle financing without putting a stress on your financial situation. This includes considering not only the loan sum but also additional costs such as coverage, maintenance, and fuel. By having a distinct understanding of your financial plan, you can investigate various motorbike finance options that align with your monetary capability.

Next, contrast the offers from different motorcycle loan providers. Search for competitive APR and beneficial terms that suit your requirements. There are many motorcycle funding companies available, and some may have specific offers tailored for certain types of motorcycles, such as high-performance bikes or off-road bikes. Take the time to review the characteristics of the loans such as payment terms, possible fees, and the flexibility of the loans. This comparison will help you find the best motorbike finance deal that not only fulfills your requirements but also ensures peace of mind.

In conclusion, feel free to negotiate with providers to secure the most favorable motorbike loan rates available. If you have a good credit history and a reliable income, you may be able to get beneficial terms. Additionally, many motorcycle financing options available online provide quick applications and feedback, making the procedure easier. By being active and knowledgeable, you can make the right choice the best financing option that allows you to experience your recently purchased motorcycle comfortably and confidently.